Estimated reading time: 8 minutes

Let the chips fall where they may. As supply chain disruptions due to the COVID-19 pandemic have resulted in a global chip shortage, carmakers and the automotive industry have been hit especially hard.

But if the last year has taught us anything, it’s that our industry can move quickly to adapt, adjust and meet the needs of our customers.

The chip shortage and supply chain constraints are out of our control. How you respond to them isn’t.

So now we have a vehicle supply and consumer demand equation to solve, with supply chain constraints as our variable. It’s time to get focused, adjust our approach and drive forward.

Here are seven key areas to consider as you start formulating your plan for success and growth through the chip shortage and imminent inventory challenges of the coming quarters. We’ll be diving deep into each of these in the coming weeks to help you navigate through this disruption, but here’s what to start thinking about:

1. Streamline your vehicle inventory acquisition to strategic sales model

The decisions you make now for your inventory strategy will determine where you land in that widening profitability and market share gap in the coming quarters. Focus on sell your car, Instant Cash Offer and private seller leads and acquisition opportunities. Instant Cash Offers continue to be a viable source for acquiring used inventory, with offers up 23% from February to March 2021.? Work your service drive, CRM, sphere of influence and lease-term avenues. If you don’t have a specific plan around each of those items, one of your competitors does.

2. Re-imagine your Certified Pre-Owned segment

People aren’t going to stop buying cars because there are fewer new cars available during the chip shortage. Train your sales team on creative conversations about the value of used inventory and re-think your selection criteria for certifying an eligible pre-owned unit. Over half of the eligible used vehicles for certification never get CPO status, but as the new car shortage continues, expanding this business segment may give you yet another competitive advantage.

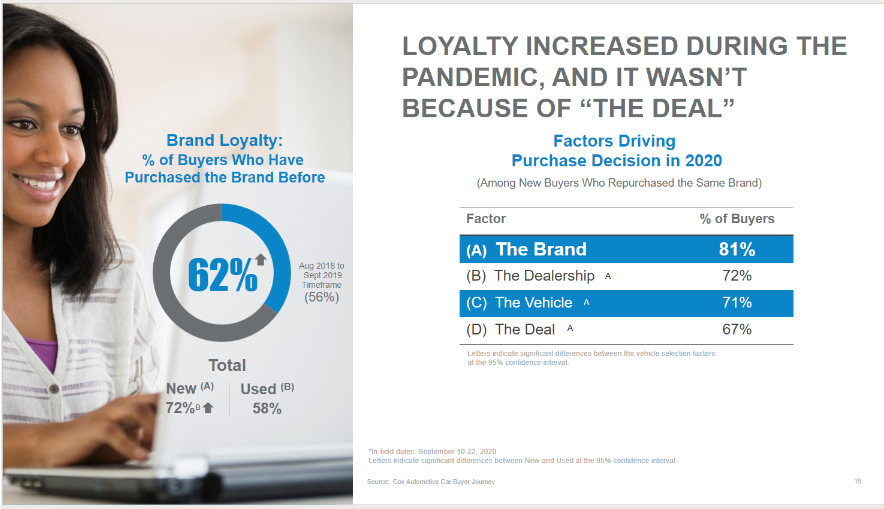

And remember why CPO is so valuable to you and to your profits: keep that new car shopper loyal, on-brand and in-market while creating back-end extended service contracts, add-on protection products and warranty wraps. In 2020, brand was the most important factor in a new car purchase decision, so keeping customers brand loyal will continue to be important to long-term customer retention. ? Most people buy new not just for that new car smell but for the peace of mind. Give your consumers that same peace of mind on the cars you have available. Our data shows that cross-shopping of new and certified inventory is increasing rapidly, with the expectation that this trend will continue to grow.

To dive deeper on CPO, read my post on how to re-imagine your CPO segment to address the new vehicle inventory shortage.

3. Lean into fixed operations now

If you have a service department, read this one over again. For most dealerships with service bays, fixed ops makes up about half of your overall profit, yet only about one-tenth of your marketing investment and probably less than one-tenth of your focus for growth. ?

We are just now starting to see the pandemic’s impact on consumer demand for service, and as consumers take to the roads again, their regular maintenance routines are resuming, they are acting on open recalls and are making purchases from locations farther from home. They’re also doing more online — with more than 5 million consumer visits to the KBB.com Service & Repair experience in 2021 so far? — which means your total addressable market is bigger than ever. But much like digital retailing 5-10 years ago, service and repair scheduling, fair and transparent repair pricing and researching are a “nice to have” competitive differentiator right now. Without these tools, though, you’ll soon be left behind.

This is your growth opportunity and it’s the perfect time for you to take advantage and grow this very stable, long-term revenue stream of your business. Open an extra shift, add a few techs, start a few hours earlier, stay open a couple of hours later, gain market share now and retain that profitability for the future. The handful of consumers who don’t buy now because of a new car shortage or higher prices will be more conscious of maintaining their current vehicle. And if they aren’t servicing with you, they are using your competitor. Remember that it’s not about the single oil change, it’s about the lifetime value potential of every customer you gain — whether they’re walking through your door or you’re going to their doorstep for service pick-up and drop-off.

4. Extend slow-moving inventory beyond your backyard

And just because you are making money now on fast-selling and high-priced vehicles doesn’t mean you should relax on growing, aged inventory. Extend that slow-moving inventory beyond your own backyard to a market where the supply is low, demand is high and there’s more opportunity than in your local market. We have data that can easily tell you where to place that inventory for fastest turn and best profitability. Take it one step further; instead of waiting until the vehicle is “aged,” buy or trade for every vehicle with the extended market plan in mind. Every dealership is on an even playing field if they embrace these ship-to-home and ship-to-store concepts to meet consumers’ expectations.

5. Be efficient with time and money

Industry-wide, we are seeing higher lead closing ratios, higher gross profits and more total sales on a month-over-month basis, which means demand is up. Used car inventory is down 11% month-over-month and new inventory is down 17% month-over-month from February to March 2021, according to Autotrader site data.? This situation makes it easy to accidentally create a scenario where your customer acquisition cost is an unnecessary black hole. Know what’s working for you and be ready to invest there. And know that you may not need every provider in the space now. Getting the right connection with the right consumer on the right car at the right time is imperative. Be there where and when they want to connect. You don’t have to be everywhere, just at the right place at the right time.

6. Consider quality over quantity

In every part of your business, quality matters, and you must know your numbers. In a technology- and data-driven world, not every opportunity is the same. Walk-ins and VDPs aren’t all the same, not all personalization is created equal, lead quality has a broad spectrum and the competitive landscape is vast. Be sure to dig into any available data to determine which strategies and tools are working for you in today’s changing market. You may find some surprises.

Get yourself out of any linear, singular approach to value and quality measurement. The “cost per this” and “cost per that” strategies are viable, but only if you are considering them as part of a larger cost-to-value equation. The world of consumer, device, activity and engagement tracking is so far beyond our old ways of thinking. We must start using those advancements to make decisions within our dealerships, especially with the increased consumer demand driven by factors like tax season, stimulus checks and loosening pandemic restraints.

7. Be nimble and aware of the volatile inventory supply-and-demand equation

Consumers don’t stop needing or wanting cars when there is a chip shortage. The life events that drive vehicle purchases don’t stop because OEMs have new production constraints; new jobs, new babies, car accidents and sweet 16 birthdays all still bring new car buyers into the marketplace. Keep a very close eye on your inventory buckets in all segments by price, type and, mostly importantly, days on lot. Keeping your finger on the pulse of which segments need creative exit strategies and which segments need aggressive acquisition strategies will keep you healthy and profitable. An imbalance of supply and demand is where you’ll find market share opportunities that will accelerate and widen the gap between you and your competition when the market starts to normalize.

Disruptions like this chip shortage are catalysts for change

We know that change is the only constant and challenges drive innovation. And with any challenge comes opportunity. Do you take on the challenge to innovate, differentiate, gain market share, get smarter and become more efficient?

Today, supply chain challenges present opportunities to rethink how you’re doing business. Tomorrow, these opportunities could be your differentiator and competitive advantage.