The Cox Automotive annual 2022 Car Buyer Journey Study is out, and the impacts of digitalization, economic challenges and industry pressures are clearly being felt. Results from the over 10,000 auto shoppers surveyed might just surprise you, as much as they did our research team!

It’s not all bad news… However, the declining satisfaction and trending statistics should be nudging our industry to take another look at their business and marketing plans in the coming year in order to gain, and keep, an auto shopper’s business.

So, let’s unpack a few of the top takeaways on what economic and industry trends affected consumer satisfaction and outline a few ways you can successfully overcome these hurdles shaping auto consumers’ wants, needs and preferences for the road forward.

The results from the annual Car Buyer Journey Study

The study was created from surveying more than 10,000 consumers who were in the market for a vehicle in 2022 – Ooh. As part of the process, dealers were also surveyed, and most of the research was conducted during the second half of 2022.

Since 2009, Cox Automotive’s annual Car Buyer Journey Study has offered a comprehensive look at the overall vehicle buying process in the United States, with an eye toward consumer satisfaction. The goal of the study is to provide a view of the complete journey through researching, shopping and the many purchase steps required to complete the deal – for both new- and used-vehicle buyers.

With this wholistic view, it was clear that buyer satisfaction was down due to economic and industry challenges.

Needless to say, the last couple years have been especially tough for the automotive industry. Near the end of Q1 of 2021 our industry, and most consumers, realized that the chip shortage was becoming a real problem. The resulting challenges of low inventory and higher vehicle prices that would follow in 2022 greatly disrupted gains made in consumer satisfaction with the overall car buying experience.

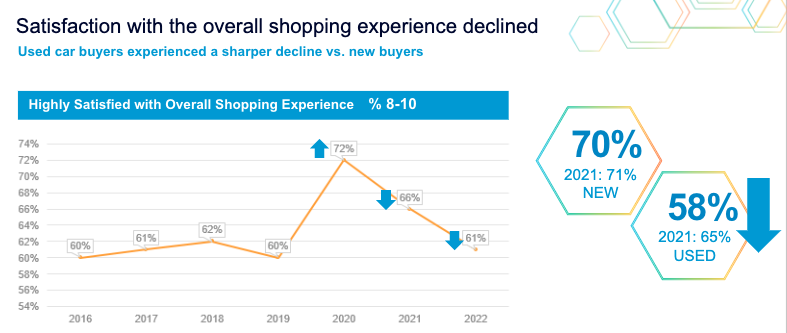

Consumer experience ratings have dipped again, and are back down to pre-pandemic levels. Today, 61% of buyers told us they are highly satisfied, as satisfaction fell significantly for the second consecutive year in a row.

In addition, only 31% of buyers told us their recent car buying experience was better than their previous buying experience. That’s down from 43% in 2020. At the same time, a growing percentage of buyers say the experience is or was worse. Many attribute this declining sentiment to the pain of finding available inventory and climbing vehicle prices.

New Car – Percentage that are highly satisfied with overall shopping experience:

2022: 70% (down)

2021: 71%

2020: 74%

Used Car – Percentage that are highly satisfied with overall shopping experience:

2022: 58% (down)

2021: 65%

2020: 71%

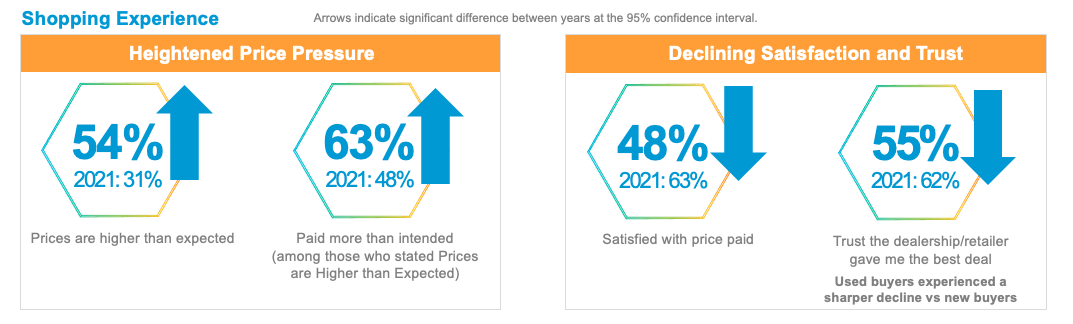

Pricing affected car buyers’ journey and satisfaction

Pricing has played a large part in the declining satisfaction results from consumers and shoppers alike, but let’s dig a bit further on how price affected all the various aspects of the consumer’s car buying process and journey.

The study found that the average list price went up for both new and used vehicles by roughly $8,000 in just the past two years alone.

Consumers responded to these increases by telling us that they did in fact notice higher prices than expected and they paid more than they budgeted. This in turn caused them to be more dissatisfied with their deal, which ultimately had an impact on the relationship between the buyer and their dealer/retailer. The survey revealed it reduced the trust they had in the deal overall, as well as their retailer.

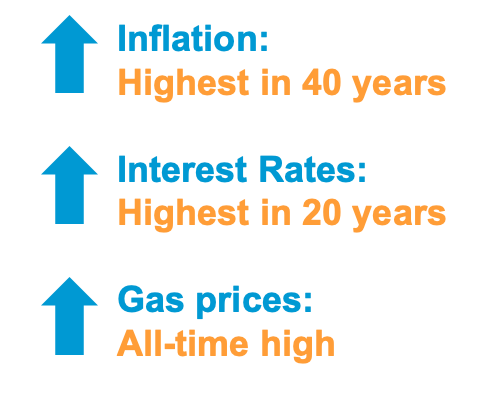

Macroeconomic factors also affected the car buying decision

Next let’s look at the macroeconomic factors that also played a part in the shifted buying behaviors and decisions as well as the car buyer’s satisfaction levels…

Inflation: This was not just a blip on the radar last year, inflation was a major economic factor that affected more than the auto industry – it affected every US citizen. So much so that it was recorded as the highest it had been in 40 years. Consumers, being keenly aware of inflation, said it shaped their buying decisions, knowing inflation was directly tied to both the purchase price and their car’s value.

Interest Rates: With skyrocketing interest rates came large hurdles for auto shoppers and dealers when it came to affordability. Gone were the days of 0% or low interest financing and large financial incentives, and customers saw prime rates climb to over 10% for used vehicles in certain situations at the end of 2022. Many sub-prime buyers saw rates double that, and were priced out of the market due to affordability and not being able to qualify for the car payment in their debt-to-income ratio set by lenders. Interest rates climbed to the highest they had been over the past 20 years.

Gas Prices: At an all-time high in many parts of the country in 2022, gas prices mostly had an effect on the make and type of car auto shoppers had in consideration and ultimately purchased. EV’s and hybrids continued to gain popularity, and OEMs moved forward with commitments to release more fuel-efficient and electric vehicle models in the coming year.

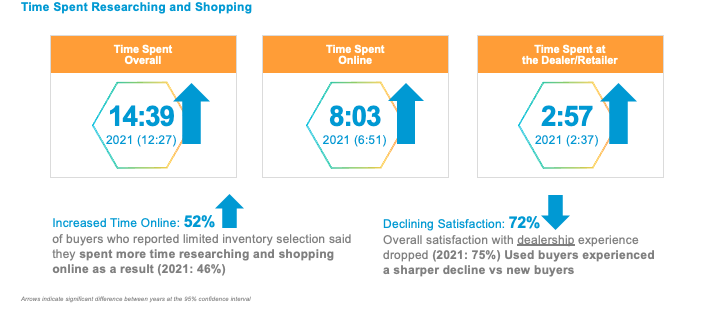

The purchase process became less efficient for auto shoppers

By far, the most noteworthy change in the car buying journey this year is how much time buyers are spending during the purchase process. And they were not happy about it.

In 2021, the average time spent by a buyer from beginning to end in the purchase process was at an all-time low. Today, time spent is nearly at an all-time high again – with buyers spending just under 15 hours researching and shopping for their next vehicle purchase.

Why is that so significant? That’s 2 hours more than last year.

As you can see in the graphic above, buyers are also spending more time at the dealership, which has resulted in a declining satisfaction with the dealership experience. However, the most significant shift is the increased time buyers are having to spend researching online due to limited inventory.

The good news shoppers, buyers and dealers agree on: digital solutions made the car buying journey better

Nearly all auto dealers – 87% – indicate that digital retailing solutions have positively impacted at least one area of their business, reducing time spent, improving efficiency, and resulting in a benefit to sales, profits, and relationships with customers.

Most importantly, 81% of shoppers in 2022 noted that

online activities improved the overall buying experience.

Transacting online saves time, according to buyers, and 78% of buyers believe an eCommerce approach provides greater transparency around pricing, and 86% say it allows them to interact with fewer dealership sales personnel, which they viewed as removing a typical pain-point.

‘Mostly Digital’ buyers – those who complete more than

50% of the purchase process steps online –

were the most satisfied among all buyers.

The results indicated that 67% of Mostly Digital buyers were satisfied with the buying experience compared to 49% of Light Digital buyers, who perform less than 20% of the steps online. Mostly Digital buyers are also more likely than Light Digital buyers to feel the dealership gave them a good deal. They were also more satisfied with the amount of time spent during the buying process and at the dealership.

In the year ahead, Cox Automotive forecasts that half of all vehicle buyers will engage with at least one digital tool during the purchase process, and 80% of shoppers said they’d be willing to fully transact online within the next 5 years.

For the road forward

Despite a declining overall satisfaction with the car buying journey in 2022, by understanding what today’s car shopper wants, needs and prefers, you’ll be able to remove some of the hurdles that macroeconomic and industry challenges have presented. Buyers still are showing demand, supply is increasing, and there is opportunity for growth in the coming year for the dealers to make the process less frustrating for in-market auto shoppers.

By taking a closer look at the experience you offer car buyers on-line and how that bridges into in-person, improving efficiencies and transparency, and showcasing how your brand’s experience stands out as the one a consumer should choose, you’ll not only gain a car shoppers attention, but you’ll also gain (or retain!) their business.

Autotrader provides you with qualified leads for people that want cars. We have the data, and we have the shoppers. We know what they want, and our goal is to match them with our dealer partners, driving quality leads and delivering a 35% higher gross profit on average. We connect you with customers virtually, to move shoppers to you, so that you can focus on building and letting your brand shine.

Cox Automotive has the most connected and comprehensive view of the automotive industry and offers unmatched data and insights into consumer behavior, automotive trends, and operational best practices. Whatever your goals, we can help you get there faster and to stay a step ahead and successful in today’s marketplace.